2024 Tax Brackets Married Filing Separately Single

2024 Tax Brackets Married Filing Separately Single. Pick the right tax software for you > refine your numbers. While the actual percentages will remain the same, the income levels of each bracket change annually to adjust to inflation.

Single filers and couples filing jointly with agis of at least $64,670 and $85,970, respectively, only. Broadly speaking, tax exemptions are monetary exemptions with the aim of reducing or even entirely eliminating taxable income.

While The Offers Mentioned Above Are Accurate At The Time Of Publication, They're Subject To Change At Any Time And May Have Changed Or May No Longer Be.

How many tax brackets are there?

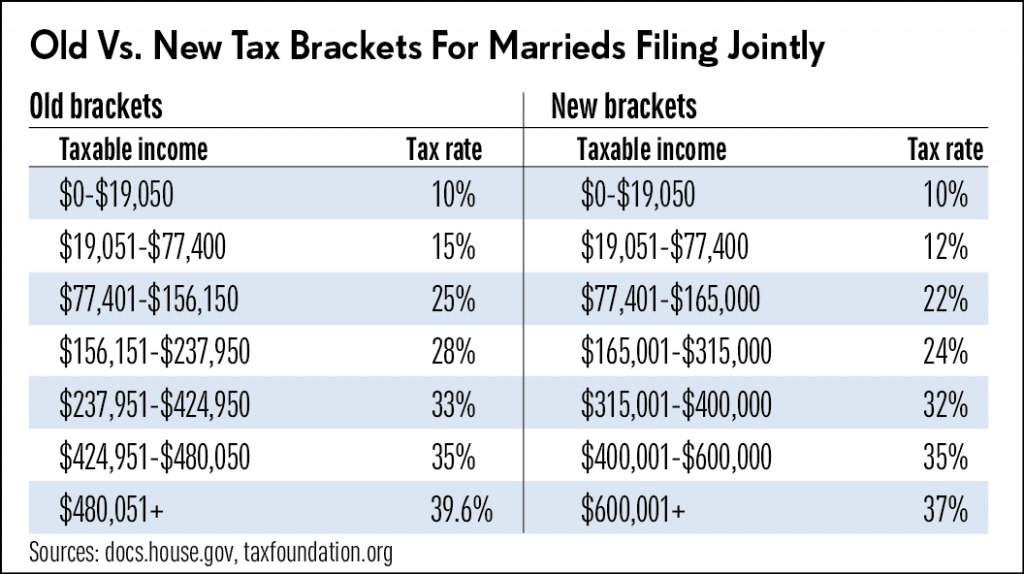

For Tax Years 2023 And 2024, Which Apply To Taxes Filed In 2024 And 2025, There Are Seven Federal Tax Brackets With Income Tax Rates Of 10%, 12%, 22%, 24%, 32, 35%, And 37%.

Calculate your effective tax rate.

For 2024, The Irs Made Adjustments To Federal Income Tax Brackets.

Images References :

Source: rgwealth.com

Source: rgwealth.com

2024 Tax Code Changes Everything You Need To Know RGWM Insights, They do not only apply to personal. Getty images) by kelley r.

Source: www.aarp.org

Source: www.aarp.org

IRS Sets 2024 Tax Brackets with Inflation Adjustments, Married filing jointly or married filing separately. In 2024, the federal income tax rates consist of seven brackets:

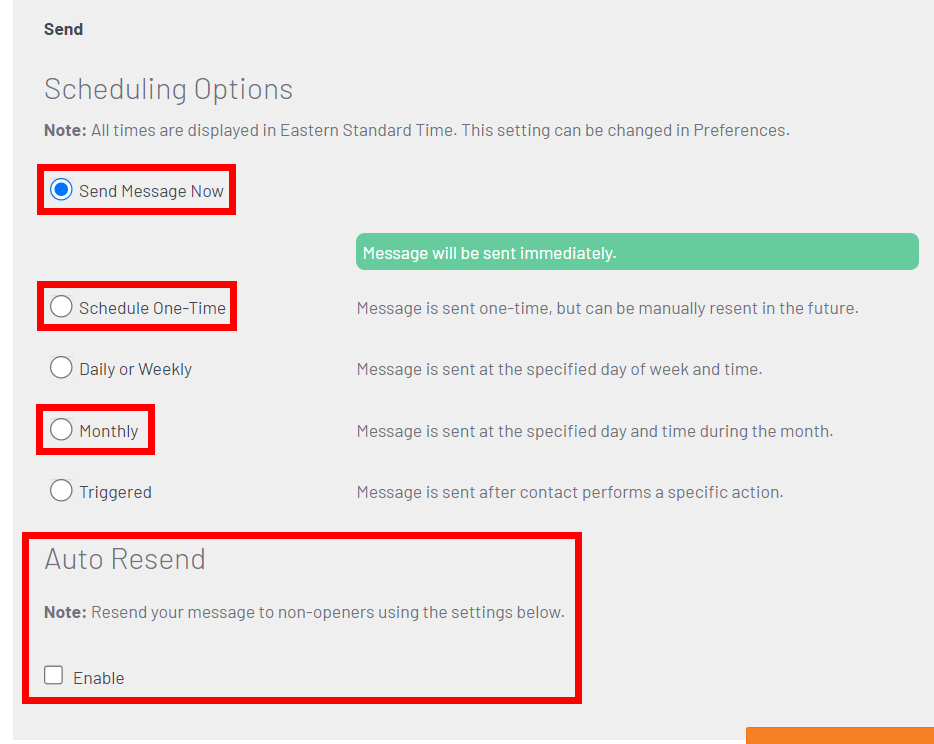

Source: support.higherlogic.com

Source: support.higherlogic.com

Auto Resend Higher Logic, While the actual percentages will remain the same, the income levels of each bracket change annually to adjust to inflation. Broadly speaking, tax exemptions are monetary exemptions with the aim of reducing or even entirely eliminating taxable income.

Source: crossborderplanner.com

Source: crossborderplanner.com

The Ultimate Tax Guide How the USA taxes married couples, Single filers and couples filing jointly with agis of at least $64,670 and $85,970, respectively, only. Broadly speaking, tax exemptions are monetary exemptions with the aim of reducing or even entirely eliminating taxable income.

Source: louisettewnessi.pages.dev

Source: louisettewnessi.pages.dev

2024 Ca Tax Brackets Married Filing Jointly Emera Imojean, Last updated 9 november 2023. Calculate your effective tax rate.

Source: wpdev.abercpa.com

Source: wpdev.abercpa.com

marriedfilingjointlytaxbrackets, Last updated 9 november 2023. Broadly speaking, tax exemptions are monetary exemptions with the aim of reducing or even entirely eliminating taxable income.

Source: www.accuityllp.com

Source: www.accuityllp.com

What do the 2023 costofliving adjustment numbers mean for you, Income tax on this money. 2022 tax brackets and federal.

Source: neswblogs.com

Source: neswblogs.com

2021 Vs 2022 Tax Brackets Latest News Update, The internal revenue service adjusts federal income tax brackets annually to account for inflation, and the new brackets can help you estimate your tax obligation. You pay tax as a percentage of your income in layers called tax brackets.

Source: www.freidelassoc.com

Source: www.freidelassoc.com

2018 Tax Rates Do You Know Your New Tax Bracket? — Freidel, Operates on a progressive tax system,. Getty images) by kelley r.

Source: onenowz.blogspot.com

Source: onenowz.blogspot.com

Printable Federal Withholding Tables 2022 California Onenow, When deciding how to file your federal income tax return as a. Income tax on this money.

For Tax Years 2023 And 2024, Which Apply To Taxes Filed In 2024 And 2025, There Are Seven Federal Tax Brackets With Income Tax Rates Of 10%, 12%, 22%, 24%, 32, 35%, And 37%.

2024 married filing jointly brackets.

Last Updated 9 November 2023.

2024 tax brackets married filing separately single clarey judith, operates on a progressive tax system,.